Comments on “Population Quantity, Quality and Mobility,” by Jere R. Behrman and Hans-Peter Kohler

Ronald Lee

This concept note does a terrific job of setting out many of the ways that changing demography will pose challenges for policy, income distribution, and economic development. Many important aspects of the topic are highlighted, including some that had not occurred to me. Quality gets the attention that the title of the paper suggests it deserves. There are many fresh ideas and insights and novel ways of looking at the data. The policy recommendations are interesting and most strike me as on target.

There are some parts of the report where I would change the emphasis or introduce different material, and there are some policy recommendations with which I disagree. My comments draw on data from the National Transfer Accounts project (ntaccounts.org), a comparative international project that quantifies the ways in which people of different ages access economic resources in different countries.

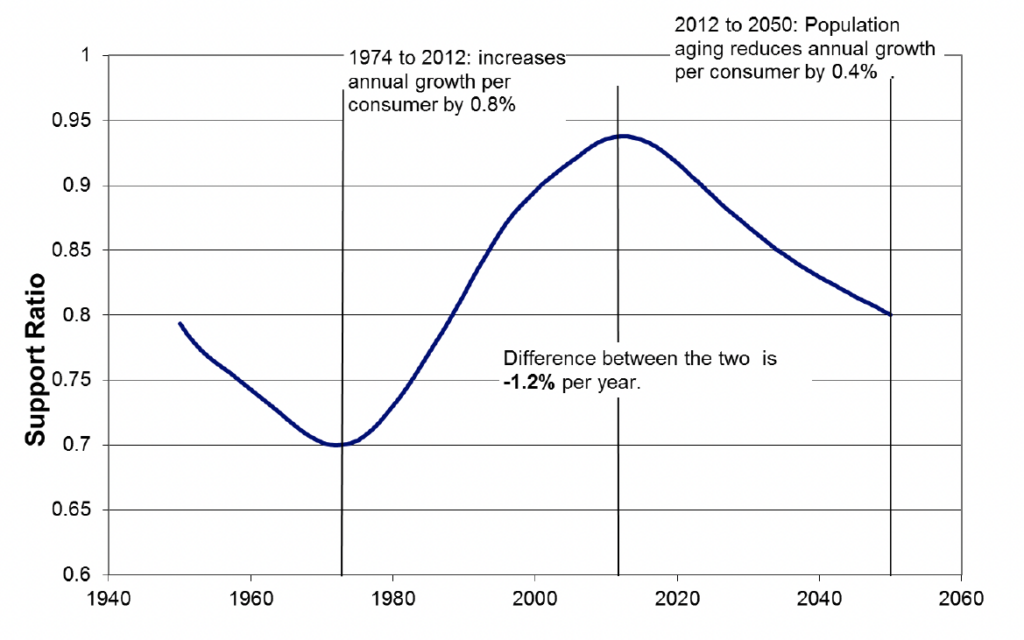

The “demographic transition” is a useful organizing framework for this paper, and the authors rightly emphasize that countries are distributed across different stages of the transition and that their positions in the transition fundamentally impact their economies. The transition starts with the inception of the mortality decline, which, together with continuing high fertility, leads to an increase in the number and population share of the young, the so-called “youth bulge.” Members of this bulge eventually enter the labor force, where they may be productively employed, as they were in Taiwan and the Republic of Korea. Alternatively, they may experience low employment rates, as they have in Nigeria and South Africa. In either case, a decline in fertility reduces the number and population share of dependent children, raising the support ratio. This change is a benefit in the sense that per capita household incomes and per capita national income will be higher. This benefit of fertility decline, known as the “first demographic dividend,” generally continues for 30–70 or more years. These aspects of the demographic transition are illustrated in figure 1, which shows the support ratio for China.

Ronald Lee is the Edward G. and Nancy S. Jordan Family Professor of Economics, a professor of demography, and the director of the Center on Economics and Demography of Aging at the University of California at Berkeley. These comments were prepared for the Towards a Better Global Economy Project funded by the Global Citizen Foundation. The author alone is responsible for the content. Comments or questions should be directed to rlee@demog.berkeley.edu.

Figure 1 Support Ratio for China, 1950–2050

This first dividend is ultimately a transitory benefit, which is reversed when lower fertility and longer life eventually lead to population aging, as support ratios fall back toward their pretransition levels or below. For the developed world and much of the developing world, this “first dividend” arising purely from rising support ratios is done or almost done. China, for example, has just reached its peak support ratio; other things equal, population aging will be costing it about half a percent of annual per capita income growth between now and 2050 (Lee and Mason 2012).

It is useful to consider the ways other things may not be equal—ways in which the transitory advantages of a high support ratio as fertility declines may be captured and made permanent in the form of increased investments in human capital and increased physical capital. These effects of the changing population age distributions are sometimes referred to as the “second demographic dividend” (Lee and Mason 2011). There is strong interest in these concepts among policy makers in parts of the developing world. For example, at the meeting of African Ministers of Finance, Economics and Planning in Abidjan in March of 2013, there were various presentations on the topic.

While I agree with much of what the authors say about these matters, I disagree with the discussion of aging in Asia and the classification of East Asia as being “post-transition” with an “older population age structure.” I also do not think the average age is the best metric for aging, since it can rise as fertility falls with no increase in the ratio of the elderly to the working-age population. Aside from Japan, the East Asian countries are not old. In fact, they have just come to the end of their first demographic dividend phase and are now poised at their peak support ratios; they are just about to start population aging. Even in the world’s oldest major country, Japan, the old-age dependency ratio will roughly double between now and 2050. In an important sense, the full force of population aging is still decades away in every country, even the richest ones, and has yet to be experienced anywhere.

One of the most striking sections of the paper is the discussion of education. The deep and extensive use of the studies by Lutz and his coauthors presents material that has only recently been developed and has not yet been integrated in demographers’ thinking, so this section brings great value added. Another valuable contribution on education is the discussion of education other than formal schooling, including stimulation of children before they reach school age and the micronutritional quality of their diets. These points are quite new and not yet widely appreciated. They are a very welcome and valuable part of the paper.

Within the economics of fertility, the quantity-quality tradeoff refers to the necessary choice by parents between the number of children (quantity) and the average amount they can spend (on care and investment in human capital) on each child (quality) (Becker and Lewis 1973; Willis 1973). The general idea is that as development proceeds and incomes rise, couples would like to choose both more quantity and more quality, but their desire for quality rises faster, making incremental children more costly. Consequently, the number of children declines. Development-driven increases in the rate of return to investments in quality, predominantly schooling, could also tilt parents to having fewer kids.

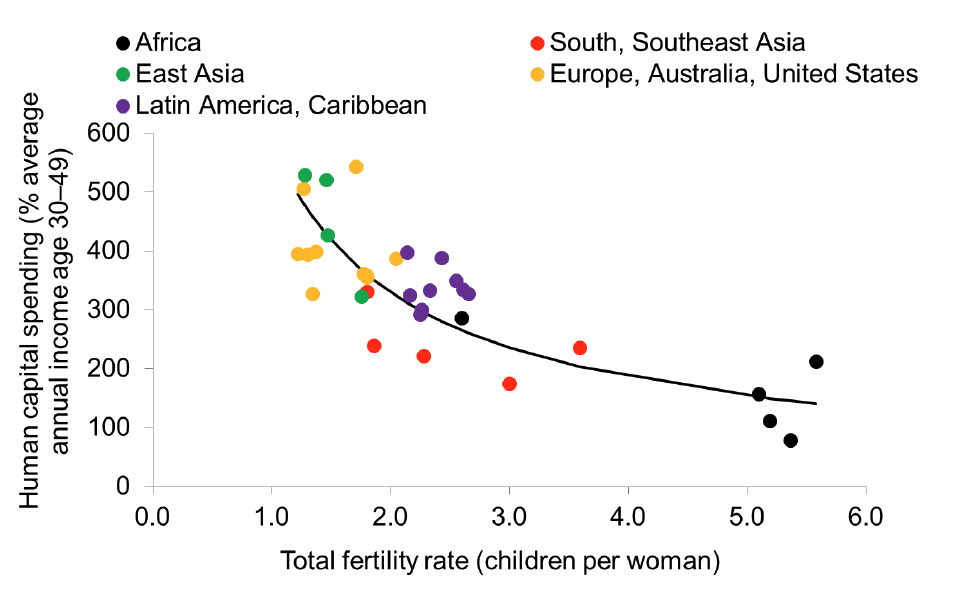

Figure 2 shows the relationship between expenditures on human capital investment per child and the level of fertility by world region. Expenditures on human capital are the sum of public and private spending. They are standardized by dividing by the average per capita labor income in each country for people 30–49. A strong negative relationship is evident, with an elasticity of about –0.7. While one cannot be sure about the direction of causation, it is hard to avoid the conclusion that the increase in quality is closely associated with the decline in fertility. This link is one part of the “second demographic dividend.”

Figure 2 Association between Base-Period Fertility and Investments in Human Capital, by World Region

Note: Human capital investment per child is the sum of public and private per capita expenditures on health for people 0–17 and on education for people 3–26. These sums are then divided by average labor income for people 30–49 in each country. Fertility is measured during the five years before the base year for the National Transfer Account estimates.

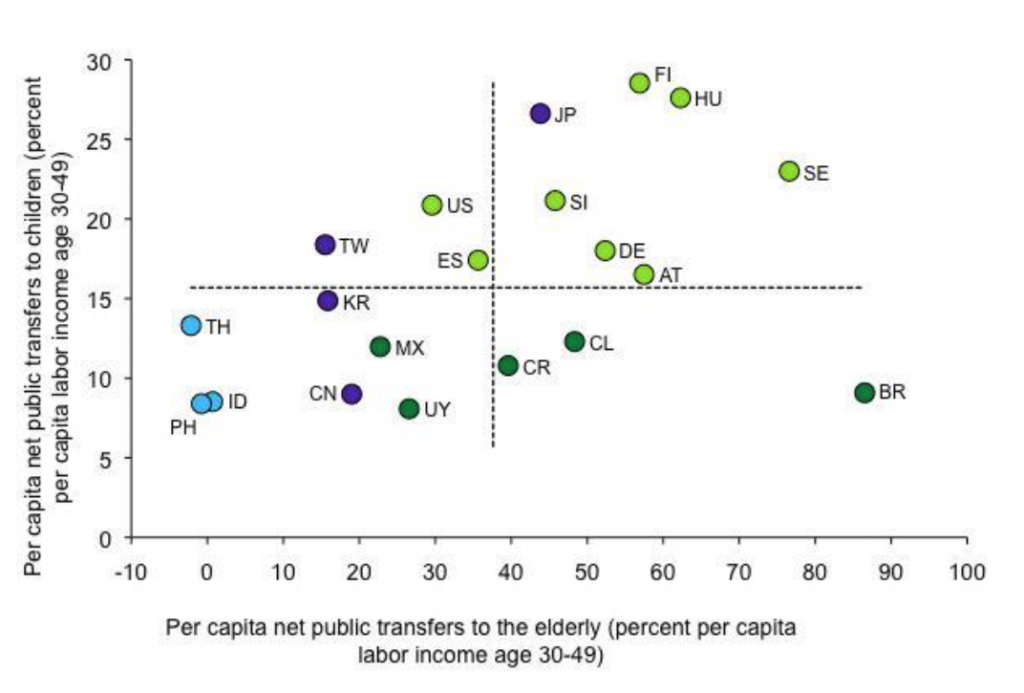

There is an interesting and important public-private issue here. Other data from the National Transfer Accounts reveal strong regional patterns of public spending on children and the elderly (figure 3). Asia stands out for low public spending on both children and the elderly. In Latin America, public spending is high on the elderly and low on children. In Europe, spending is high on both.

Figure 3 Net Public Transfers to Children and Adults, as Percentage of Labor Income of Adults 30–49

Note: Net public transfers are benefits received minus taxes. Dotted lines represent median values. Circles represent countries, identified by United Nations two-letter country codes. The color of the circle indicates the region: blue = South or Southeast Asia; purple = East Asia; light green = Europe and the United States; dark green = Latin America.

What are the consequences of low spending on children? Taking Brazil as an informative example, high-income parents spend twice as much on private education as poor parents (ECLAC 2010). This pattern of investment in the human capital of children tends to preserve the high socioeconomic status of the children of the rich, replicating the social hierarchy in the next generation. In East Asia, there is very high private spending on education, roughly equal to public, but I do not know its class distribution. In Asia, private spending (on cram schools etc.) complements public spending; in Latin America, it generally buys alternative education (private instead of public). In the National Transfer Accounts data, most of the quantity-quality tradeoff seen in figure 2 is due to public spending on education rather than private spending. Countries tend to spend similar proportions of GDP on public education. As a result, the amount per child varies with fertility and the proportion of children in the population.

An increasing number of countries are in the process of population aging (all of Europe, Japan, North America, Taiwan, and Korea) or will soon be starting the process (China, much of South America). In Sub-Saharan Africa, population aging is far in the future; countries are still early in their dividend phase, and fertility is still relatively high. The paper does a good job of taking this heterogeneity into account. It seems correct in noting that the dangers of population aging are often exaggerated.

As the population in high-income countries has aged, there has been a huge expansion of the welfare state, in the form of dramatically increased transfers to the elderly. This expansion has been driven partly by increased public provision of health care and long-term care for the elderly. It is not only the rich countries (including Japan, the United States, and Canada as well as Europe) that have followed this route; a number of Latin American countries (most strikingly, Brazil) have done so as well. A consequence is that consumption by the elderly, including consumption of health care, has increased greatly relative to consumption by younger people.

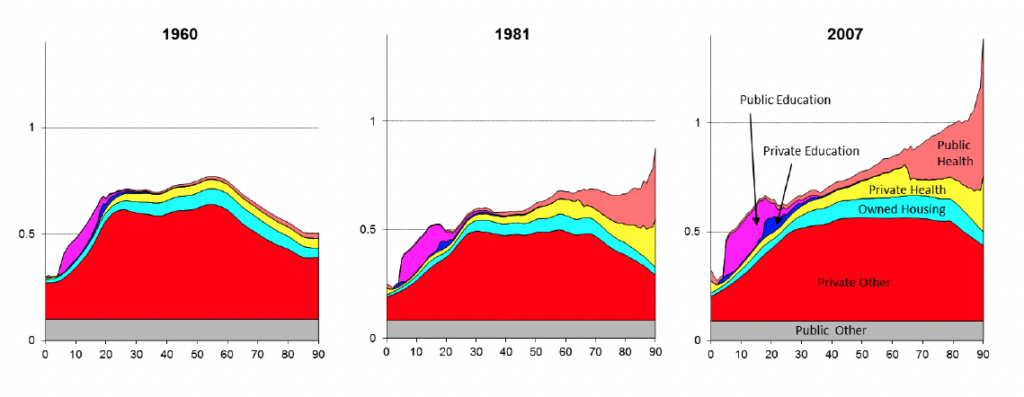

Figure 4 shows cross-sectional age profiles of U.S. consumption in 1960, 1981, and 2007. It also shows the composition of consumption, including both public and private spending per person, on health care. The rising relative consumption by the elderly interacts with population aging to make population aging increasingly costly. Consumption expenditures have tilted dramatically toward older ages, in part due to increased public provision of health care.

Figure 4 Composition of Consumption by Age in the United States, 1960, 1981, and 2007

I am pleased to see that problems of disability and chronic illness receive useful attention in the section on aging, with good discussions of relevant policies to improve health at older ages through interventions at earlier ages. The emphasis is on implications for health care systems and both public and familial transfer systems, presumably on the assumption that healthier elders will require less costly health care inputs, will be able to work longer, and will generally be more self-sufficient. All this is good. Let me add a couple of points.

First, a slightly different angle might be taken on old age health, disability, and functional status (in addition to the current one). It draws on the studies on trends in disability (the Activities of Daily Living Scale, the Instrumental Activities of Daily Living Scale, and related standardized items) as measures of the quality of life of older people. I am not sure exactly what the international data show, but for the United States, disability rates were declining in the 1980s and 1990s and perhaps throughout the whole 20th century. This is very good news, suggesting that the years of life gained through declining mortality were years of health and activity. Unfortunately, that trend appears to have ended around 2000, with some evidence of increasing disability rates by some measures and flat disability by other measures (National Research Council 2012). Furthermore, it appears that disability rates have been rising at older working ages (say, 40–64), along with obesity. These unfortunate trends, if present in other rich and also perhaps developing countries, are very bad news, both for human welfare of the elderly and for their public and private support systems, which will already be strained by the rising proportions of elderly. There should be broader evidence on these points for other countries from the various health and retirement–type surveys now being conducted in parts of Asia and Latin America, but I don’t know what they show. The paper already covers this issue well from one angle; this would be another.

The authors present various policy recommendations. Most of them look very good, but there are some that I question or would put differently.

Capturing the Transitory Dividend by Human Capital Deepening

Some part of fertility decline is driven by the wish of parents to invest more in their children’s human capital, particularly education. As I discussed earlier, spending per child on human capital is inversely related to fertility levels, reflecting both public and private spending (see figure 2). Over the past few decades, fertility decline has been accompanied by greatly increased educational investment. Policy can support this natural tendency by maintaining or increasing aggregate public spending on education relative to GDP even as fertility and population shares of children fall. Human capital deepening generates positive externalities. The increase in labor productivity helps offset the decline in the number of workers relative to the elderly as populations age.

Capturing the Transitory Dividend through Capital Deepening

I am uncomfortable with some of the policy suggestions about pensions and agree with others. I missed any mention of funded versus Pay As You Go (PAYGO) pensions; apparently it is assumed that public pensions would be PAYGO. It was also suggested that pension benefits be delinked from earning histories and that such delinking would reduce distortions. I have two thoughts about this.

First, public old-age support is already delinked from childbearing. Some analysts suggest it should be relinked, as it was under traditional systems that provided family support for the elderly. Further delinking from earnings history would distort both labor supply decisions, including retirement age, and saving and asset accumulation decisions. It would also imperil the sustainability of public pensions as populations age. Brazil followed this policy when it extended pension benefits to the rural population. The policy reduced rural poverty, but the pension program is terribly unsustainable.

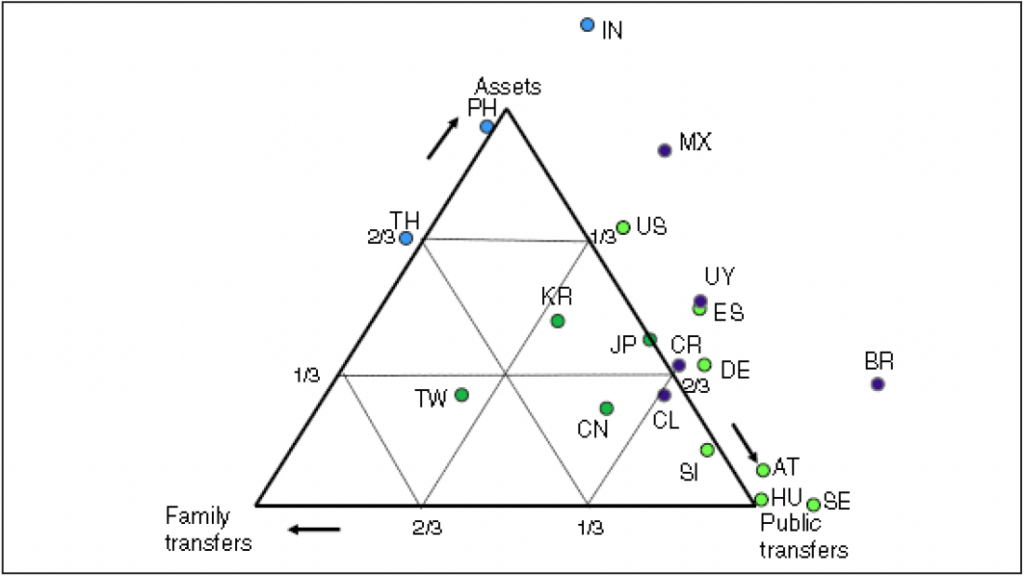

Second, in any population, older people hold far more in assets than younger people, due to a lifetime of accumulation through both inheritance and saving. As populations age, the proportion of asset-holding elders rises, leading to an increase in capital per worker (capital deepening). Whether or not capital deepens depends on how assets are invested and the openness of the economy. Longer lives and lower fertility may reinforce the pattern of asset holding by the elderly to provide for retirement consumption. In most rich countries and some middle-income countries in Latin America, this tendency may be undermined by excessive reliance on public PAYGO pensions. In many countries, elders rely virtually entirely on public transfers to fund their consumption, while still managing to make substantial net transfers to their children and grandchildren (figure 5).

Figure 5 Funding of Net Consumption by the Elderly

Note: Figures shows the relative shares of public transfers, private transfers, and asset income less saving to fund net consumption (consumption minus labor income) by people 65 and over in selected countries represented by colored circles. Circles located to the right of the triangle indicate that the elderly make net private transfers to younger members of the population. Circles represent countries, identified by United Nations two-letter country codes. The color of the circle indicates the region: light green = Europe and the United States; dark green circles = East Asia; purple = Latin America; light blue =South and Southeast Asia.

I suggest that developing countries should encourage private saving, including through mandatory saving programs for workers, starting decades before population aging is projected to begin. Prefunded public pension programs are also possible, although in practice they run great risk of being drained by governments. A policy of growing reliable financial institutions to facilitate private retirement accounts might be preferable. Encouragement of private saving for retirement does not preclude PAYGO public pensions—it should supplement them. The idea is to harness the power of population aging to drive up the capital to labor ratio, as well as to reduce pressure on the future on the working-age population to fund the elderly through family transfers or public taxes and transfers. These benefits result only when actions are implemented before population aging, so that as populations age, the new elderly arrive with important asset holdings.

Investing in Education

It is true that pricing health and educational services for children would help bring private and social costs of children into line. However, it would also affect parents’ decisions about the number of children and investment in the human capital of children. The outcome might be lower human capital investments in children, with a loss of social external benefits from human capital. The recommendation does mention possible lump-sum taxes (presumably per capita at time of birth), which could be consistent with no charges for publicly provided health and education. But such policies do not seem realistic or desirable, for distributional reasons.

East Asia provides an example of what this approach might look like. It provides minimal public spending on education, which is heavily supplemented by private spending. This practice has led to (or is associated with) very low fertility and very high human capital investments. But the distributional consequences are not known. The distributional consequences of this approach are stark in Latin America: although public spending per child is similar across socioeconomic status groups (or lower for higher-status groups), the highest income group spends more than twice the public amount in Brazil and four times as much in Chile; the poorest group has almost zero private spending (ECLAC 2010). As a result, education spending on rich children in both and Chile in about three times as high as spending on poor children.

References

- Becker, G., and H.G. Lewis. 1973. “On the Interaction between the Quantity and Quality of Children.” Journal of Political Economy 84 (2, pt. 2): S279–S288.

- ECLAC (Economic Commission for Latin America and the Caribbean.) 2010. Social Panorama of Latin America 2010 United Nations, Santiago.

- Lee, R., G. Donehower, and T. Miller. 2011. “The Changing Shape of the Economic Lifecycle in the United States, 1970 to 2003.” In Aging in Asia: Findings from New and Emerging Data Initiatives, ed. J.P. Smith and M. Majmundar, 313–26. National Research Council of the National Academies, Panel on Policy Research and Data Needs to Meet the Challenge of Aging in Asia. Washington, DC: National Academies Press.

- Lee, R., and A. Mason. 2010. “Fertility, Human Capital, and Economic Growth over the Demographic Transition.” European Journal of Population 26 (2): 159–82. PMCID: PMC2860101. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2860101/.

- ———. 2011. Population Aging and the Generational Economy: A Global Perspective. Cheltenham, United Kingdom: Edward Elgar.

- ———. 2012. “Population Aging, Intergenerational Transfers, and Economic Growth: Asia in a Global Context.” In Aging in Asia: Findings from New and Emerging Data Initiatives, ed. J.P. Smith and M. 12

- Majmundar, 77–95. National Research Council of the National Academies, Panel on Policy Research and Data Needs to Meet the Challenge of Aging in Asia. Washington, DC: National Academies Press. http://www.nap.edu/openbook.php?record_id=13361&page=77.

- Li, L., Q. Chen, and Y. Jiang. 2011. “The Changing Patterns of China’s Public Services.” In Population Aging and the Generational Economy: A Global Perspective, ed. R. Lee and A. Mason, 408–420. Cheltenham, United Kingdom: Edward Elgar.

- Mason, A., and R. Lee. 2006. “Reform and Support Systems for the Elderly in Developing Countries: Capturing the Second Demographic Dividend.” Genus 62 (2): 11–35.

- ———. 2011. “Population Aging and the Generational Economy: Key Findings.” In Population Aging and the Generational Economy: A Global Perspective, ed. R. Lee and A. Mason, 3–31. Cheltenham, United Kingdom: Edward Elgar.

- Miller, T. 2011. “The Rise of the Intergenerational State: Aging and Development.” In Population Aging and the Generational Economy: A Global Perspective, ed. R. Lee and A. Mason, 161–84. Cheltenham, United Kingdom: Edward Elgar.

- National Research Council. 2012. Aging and the Macroeconomy: Long-Term Implications of an Older Population. Committee on Long-Run Macroeconomic Effects of Aging U.S. Population. Washington, DC: National Academies Press.

- Turra, C. M., B.L. Queiroz, and E.L.G. Rios-Neto. 2011. “Idiosyncrasies of Intergenerational Transfers in Brazil.” In Population Aging and the Generational Economy: A Global Perspective, ed. R. Lee and A. Mason, 390–407. Cheltenham, United Kingdom: Edward Elgar.

- Willis, R. 1973. “A New Approach to the Economic Theory of Fertility Behavior.” Journal of Political Economy 81 (2 pt. 2), S14–64.